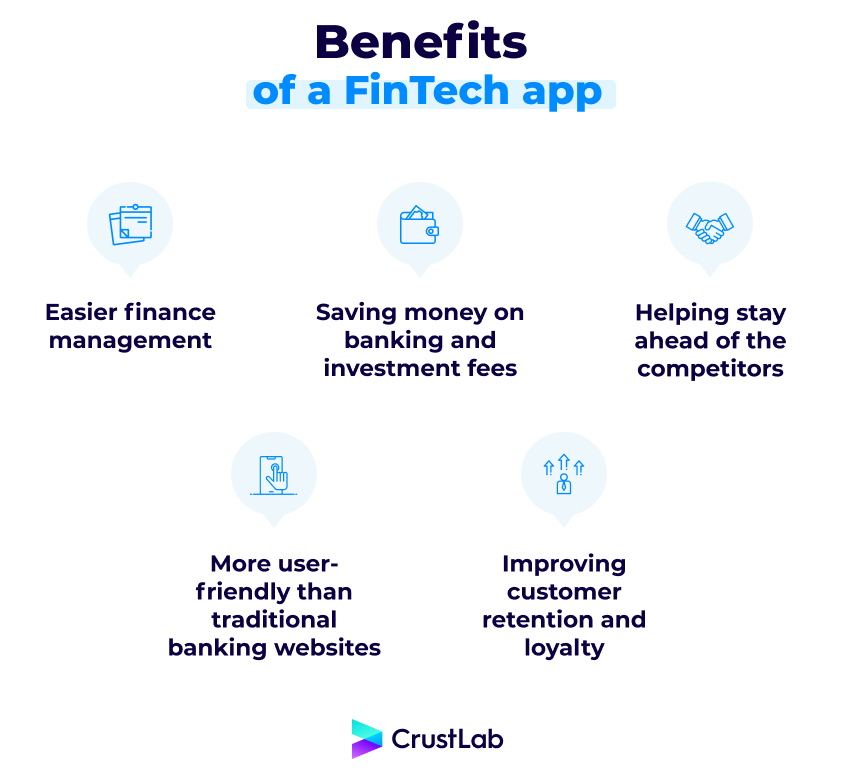

Money management is a crucial aspect of personal finance. It is not just about saving money, but also about making informed decisions that can help you grow your wealth. With the advent of technology, managing your finances has become much easier. Fintech apps have revolutionized the way people manage their money. Here are some benefits of using fintech apps for money management.

1. Real-Time Tracking

Source: bing.com

Source: bing.comFintech apps provide real-time tracking of your expenses. You can easily track your spending and see where your money is going. This helps you identify areas where you can cut back and save money. It also helps you stay within your budget and avoid overspending.

2. Automated Budgeting

Source: bing.com

Source: bing.comFintech apps offer automated budgeting tools that can help you create a budget based on your income and expenses. These tools can also help you track your progress and make adjustments as needed. This can help you stay on track with your financial goals and avoid overspending.

3. Investment Management

Source: bing.com

Source: bing.comFintech apps also offer investment management tools that can help you grow your wealth. These tools provide access to various investment options, such as stocks, bonds, and mutual funds. They also offer tools to help you diversify your investment portfolio and manage risk.

4. Lower Fees

Source: bing.com

Source: bing.comFintech apps typically charge lower fees compared to traditional financial institutions. This can help you save money on fees and invest more of your money. It also makes it easier for people with lower incomes to access financial services.

5. Personalized Recommendations

Source: bing.com

Source: bing.comFintech apps offer personalized recommendations based on your financial situation. They can help you identify areas where you can save money and make better financial decisions. This can help you achieve your financial goals faster and more efficiently.

6. Enhanced Security

Source: bing.com

Source: bing.comFintech apps use advanced security measures to protect your personal and financial information. They use encryption and other security protocols to ensure that your data is secure. This can give you peace of mind knowing that your financial information is safe.

7. Convenience

Source: bing.com

Source: bing.comFintech apps offer the convenience of managing your finances from your smartphone or computer. You can easily access your account information, track your spending, and make transactions from anywhere at any time. This can save you time and make managing your finances more convenient.

8. Financial Education

Source: bing.com

Source: bing.comFintech apps also offer financial education resources to help you improve your financial literacy. They offer articles, videos, and other resources that can help you learn about different financial topics. This can help you make better financial decisions and achieve your financial goals.

9. Better Customer Service

Fintech apps offer better customer service compared to traditional financial institutions. They offer 24/7 customer support through chat, email, or phone. This can help you get the help you need quickly and efficiently.

10. Integration with Other Apps

Source: bing.com

Source: bing.comFintech apps can also integrate with other apps to provide a seamless experience. They can integrate with apps like Mint, PayPal, and Venmo to make managing your finances even more convenient. This can save you time and make managing your finances easier.

In conclusion, fintech apps offer numerous benefits for money management. They provide real-time tracking, automated budgeting, investment management, lower fees, personalized recommendations, enhanced security, convenience, financial education, better customer service, and integration with other apps. By using these apps, you can improve your financial health and achieve your financial goals.