The Rise of Fintech

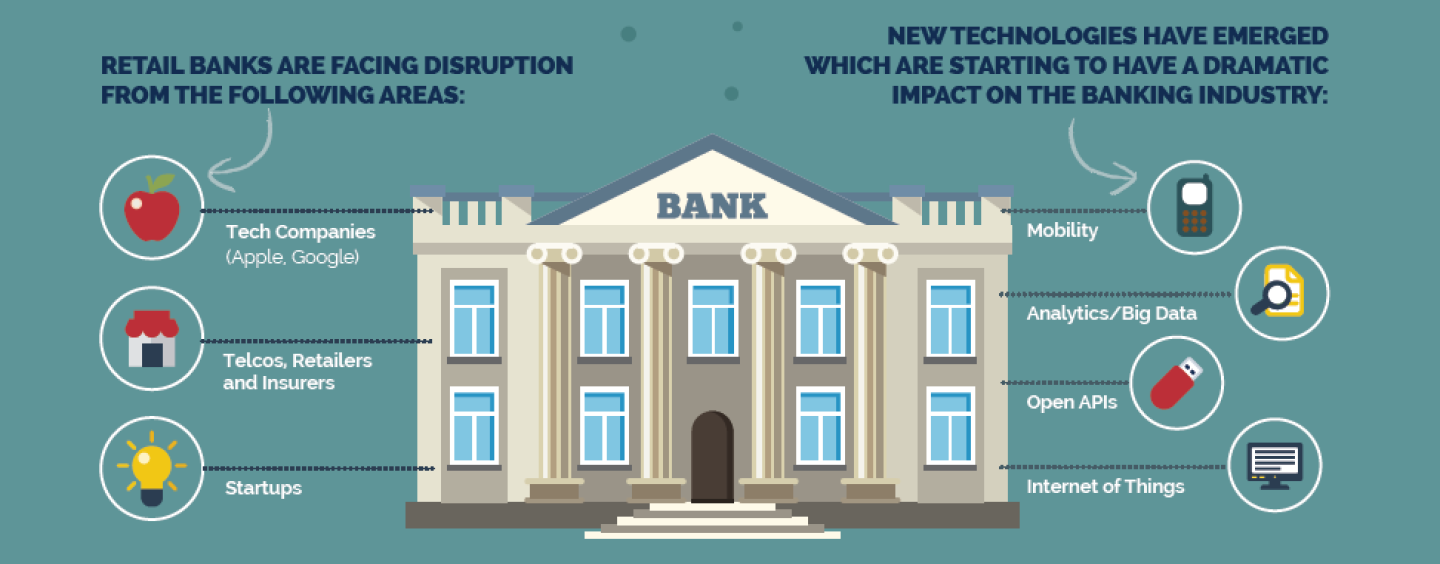

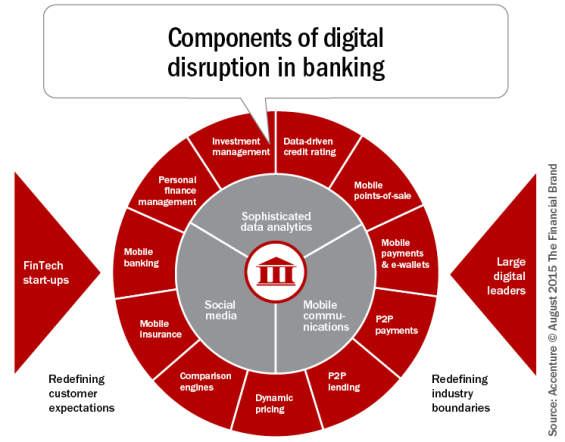

The financial technology industry, or fintech, has been rapidly growing over the past few years. Fintech companies are disrupting traditional financial institutions by offering innovative and convenient services to consumers. These services include mobile banking, online lending, and digital wallets. According to a report by Accenture, fintech investment reached $55.3 billion in 2019, up from $50.8 billion in 2018.

Source: bing.com

Source: bing.comMobile Banking

Mobile banking allows customers to access their accounts and perform transactions through their mobile devices. This has revolutionized the banking industry, making it more convenient for customers to manage their finances. In addition, mobile banking has enabled financial institutions to reduce their costs by providing services through digital channels rather than physical branches.

Source: bing.com

Source: bing.comOnline Lending

Online lending has disrupted the traditional lending process by providing access to credit for individuals and small businesses who may not qualify for loans from traditional banks. Online lenders use technology to assess creditworthiness and process loan applications quickly, making the lending process more efficient and streamlined.

Source: bing.com

Source: bing.comDigital Wallets

Digital wallets allow consumers to store their payment information on their mobile devices and make payments with just a few taps. This has made transactions more convenient for consumers and has also enabled businesses to accept payments more easily. Digital wallets are also more secure than traditional payment methods, as they use encryption and other security measures to protect sensitive information.

The Role of Artificial Intelligence

Artificial intelligence, or AI, is also playing a significant role in disrupting the finance and banking industry. AI is being used to automate processes, improve customer service, and detect fraud. In addition, AI-powered chatbots are being used to provide personalized assistance to customers.

Automated Processes

AI is being used to automate processes such as loan underwriting, risk management, and fraud detection. This has made these processes more efficient and accurate, reducing the time and resources needed to perform them manually.

Improved Customer Service

AI-powered chatbots are being used to provide 24/7 customer service to customers. These chatbots can answer frequently asked questions, provide product recommendations, and assist with transactions. This has improved customer satisfaction and reduced the workload for customer service representatives.

Fraud Detection

AI is being used to detect fraudulent transactions by analyzing patterns and detecting anomalies. This has made fraud detection more accurate and efficient, reducing the risk of financial losses for both consumers and financial institutions.

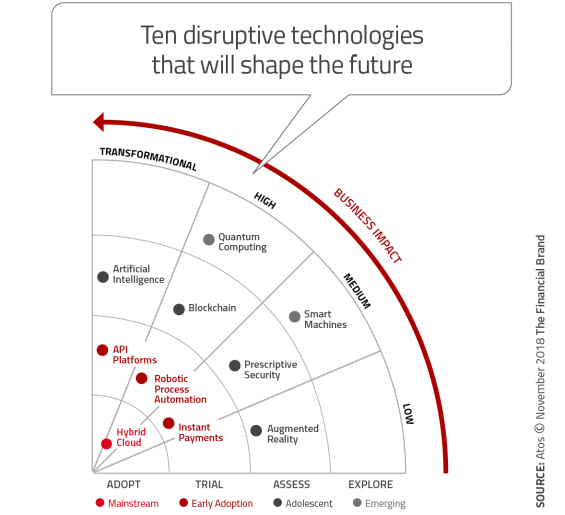

The Future of Finance and Banking

The disruption caused by technology in the finance and banking industry is only the beginning. As technology continues to evolve, we can expect to see even more innovative and disruptive solutions. Some of the future trends in the industry include:

Blockchain

Blockchain is a decentralized ledger technology that can be used to securely store and transfer information. This has the potential to revolutionize the way financial transactions are conducted, making them faster, more secure, and more efficient.

Open Banking

Open banking is a concept that allows third-party providers to access financial information from banks and other financial institutions. This has the potential to create a more competitive and innovative financial services industry, as it allows for the development of new products and services.

Big Data Analytics

Big data analytics can be used to analyze large amounts of data to gain insights and make better business decisions. In the finance and banking industry, big data analytics can be used to identify trends, assess risk, and improve customer service.

Conclusion

The disruption caused by technology in the finance and banking industry has brought about significant changes and has created new opportunities for innovation and growth. As technology continues to evolve, we can expect to see even more disruptive solutions that will transform the industry and benefit consumers and businesses alike.