Technology has transformed the way we live, work, and interact with each other. The financial and banking sectors are no exception. With the help of technology, banks and financial institutions have been able to streamline their operations and provide their customers with better services. In this article, we will explore the top finance and banking technology innovations you need to know about.

1. Mobile Banking

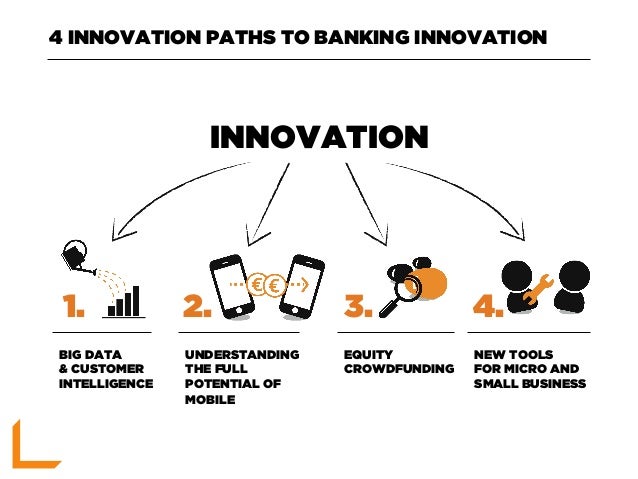

Mobile banking is a service that allows customers to conduct financial transactions through their mobile devices. With the help of mobile banking, customers can check their account balances, transfer funds, pay bills, and even apply for loans. Mobile banking has made banking more convenient and accessible for customers, and it has also helped banks reduce their operational costs.

Source: bing.com

Source: bing.com2. Online Banking

Online banking is another service that has transformed the banking industry. With online banking, customers can access their accounts and conduct transactions from anywhere in the world as long as they have an internet connection. Online banking has made banking more convenient for customers, and it has also helped banks reduce their operational costs.

Source: bing.com

Source: bing.com3. Contactless Payments

Contactless payments are a type of payment that allows customers to make transactions without physically touching the payment terminal. With contactless payments, customers can simply tap their card or mobile device on the payment terminal to complete the transaction. Contactless payments have made transactions faster, more convenient, and more secure.

Source: bing.com

Source: bing.com4. Artificial Intelligence

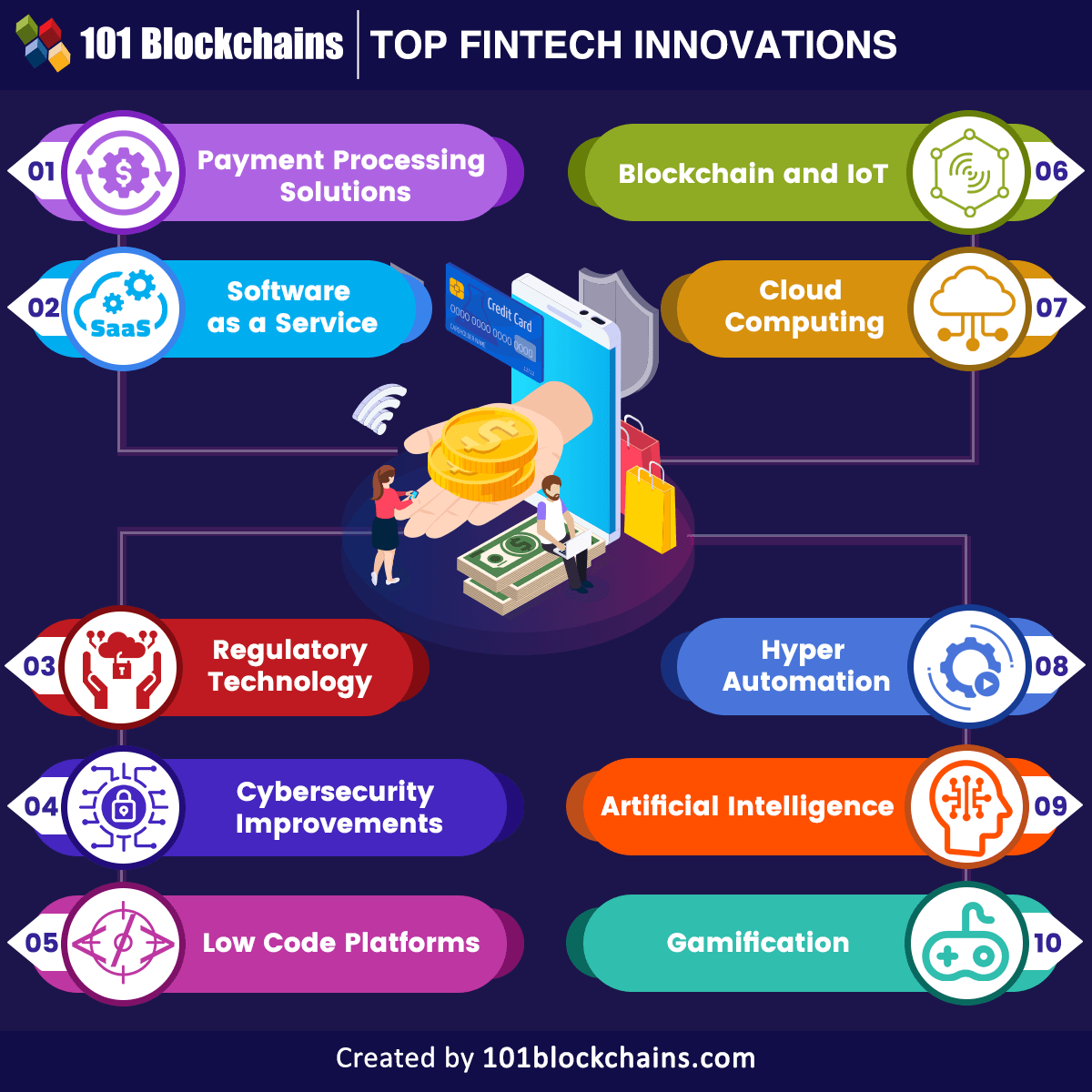

Artificial intelligence (AI) has been making waves in the banking industry. AI can help banks automate their operations, reduce their operational costs, and provide better services to their customers. With the help of AI, banks can also analyze customer data to personalize their services and offer better recommendations to their customers.

Source: bing.com

Source: bing.com5. Blockchain

Blockchain is a distributed ledger technology that has the potential to revolutionize the banking industry. With blockchain, banks can securely and transparently record transactions, reduce fraud, and streamline their operations. Blockchain can also help banks reduce their operational costs and provide better services to their customers.

Source: bing.com

Source: bing.com6. Robo-Advisors

Robo-advisors are automated investment platforms that use algorithms to provide investment advice and manage portfolios. With the help of robo-advisors, customers can access investment advice and manage their portfolios without the need for a human financial advisor. Robo-advisors have made investing more accessible and affordable for customers.

Source: bing.com

Source: bing.com7. Biometric Authentication

Biometric authentication is a type of authentication that uses biometric data such as fingerprints, facial recognition, and voice recognition to verify a customer’s identity. With the help of biometric authentication, banks can provide their customers with a more secure and convenient way to access their accounts.

Source: bing.com

Source: bing.com8. Chatbots

Chatbots are computer programs that use artificial intelligence to simulate human conversations. With the help of chatbots, banks can provide their customers with 24/7 customer service, answer their queries, and provide them with personalized recommendations. Chatbots have made customer service more efficient and cost-effective for banks.

Source: bing.com

Source: bing.com9. Digital Wallets

Digital wallets are virtual wallets that allow customers to store their payment information and make transactions through their mobile devices. With the help of digital wallets, customers can make transactions without the need for physical cash or cards. Digital wallets have made transactions faster, more convenient, and more secure.

Source: bing.com

Source: bing.com10. Big Data Analytics

Big data analytics is the process of analyzing large volumes of data to identify patterns, trends, and insights. With the help of big data analytics, banks can analyze customer data to personalize their services, offer better recommendations, and reduce the risk of fraud. Big data analytics has made banking more efficient, effective, and customer-centric.

Source: bing.com

Source: bing.comConclusion

Technology has transformed the banking and financial industry, and it will continue to do so in the future. With the help of technology, banks and financial institutions can provide their customers with better services, reduce their operational costs, and improve their overall efficiency. By keeping up with the latest technology innovations, banks can stay ahead of their competition and provide their customers with the best possible experience.